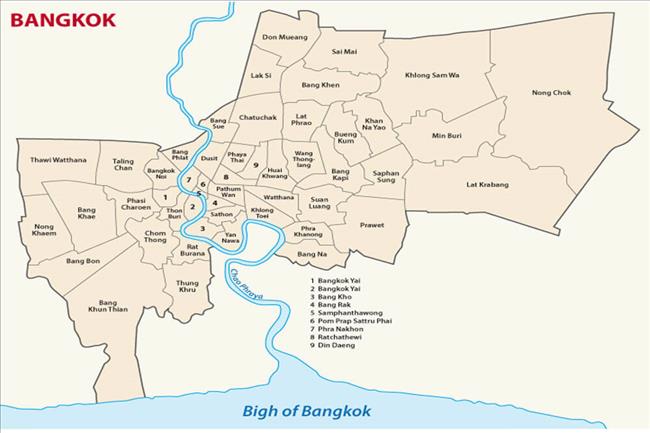

As Thailand continues to develop and grow, Bangkok is becoming a hotbed for global investors looking to get in on the booming property market. Properties in other Thai cities like Hua Hin, Phuket, Chiang Mai and Pattaya have also seen a pick up in investor interest. However, Bangkok is still the most sought-after location when it comes to Thai real estate. As we examine Thailand’s capital city, we realise that the area is vast with multiple sub-districts. Which areas have the best rental yields for property investments? Let's look at the rental yield comparisons between Northern and Central Bangkok.

What is Rental Yield?

If you have ever considered investing in property, you would often come across the term, ‘rental yield’. Considered as one of the key indicators of a property’s value and investment potential, rental yield is the annual rental income as a percentage of the property’s value. This value is important in determining how much money you can earn from renting out your property, and if the price of the property is justifiable.

Central Bangkok

To understand the climate of the property market in Bangkok, we must first understand the specific areas in this city. Central Bangkok is home to Thailand’s most iconic malls and office buildings. The area is made up of the Central Business District, which encompasses Sathorn Road, Silom Road and Wireless Road CBD corridors, as well as the tourist hub of Sukhumvit, the section of Sukhumvit Road between Soi 1 to 63 (North side) and Soi 2 to 42 (South side) and the entirety of Rama I and Ploenchit roads.

The rental yields of Central Bangkok range between 4% to 5% which some may consider to be on the lower end of Thailand’s overall property market. However, speak to any credible Thai property agent, and they will tell you that properties in Central Bangkok are your safest bet. While rental yields are not as high, rental demand and capital appreciation makes Central Bangkok properties very attractive. As the busiest area in Bangkok, finding tenants is an easy task compared to other areas. Additionally, the consistently high demand for properties in the area translates into positive capital appreciation.

While most signs point to Central Bangkok being the ideal spot for property investments, this does not mean that other areas are any less attractive.

Northern Bangkok

While the border that separates Central and Northern Bangkok is not clearly demarcated, the districts of Phahonyothin, Bang Sue, Chatuchak, Don Mueang and Saphan Mai are generally considered to be part of Northern Bangkok.

Based on condominium sales and rental incomes in the past few years, rental yields in these areas can go as high as 6%-8%. This comes as no surprise as property prices in these areas are generally lower than those located in the city centre. This is largely due to the perceived lack of rental demand and low capital appreciation. While this perception may have been true a few years ago, multiple infrastructural projects could greatly reverse these trends. The revamp of Don Mueang International Airport, new train lines extending northward and the Bang Sue Central Station mega-project are all currently underway. These projects are expected to increase rental demand and capital appreciation for properties in Northern Bangkok in the coming years.

Rental yields can be useful in deciding a location for your next property investment, but be sure to take note of the rental demand, capital appreciation and potential of the area as well. Central Bangkok offers investors the security of a steady demand for rent and attractive property prices, while Northern Bangkok is brimming with potential. Contact us at internationalbuyers@sansiri.com to find the perfect property investment opportunity.